Axiom – The Gateway to DeFi

Trade crypto perpetuals with deep liquidity, track onchain wallets & social alpha, earn SOL rewards, and manage everything with a secure non-custodial wallet—on one powerful DeFi platform.

Trusted by onchain traders • Backed by

Trade Faster. See Clearer. Earn More.

Axiom combines execution, insights, and rewards so you can focus on what matters—finding edge and compounding gains.

High-Performance Execution

Low-latency order routing and reliable fills designed for active traders and systematic strategies.

Wallet & Social Tracking

Follow smart wallets, track positions in real time, and surface Twitter/X signals without context switching.

Perpetuals on Hyperliquid

Access deep liquidity and trade perps with precision—hedge, speculate, and manage risk like a pro.

Earn Passive Yield

Put idle assets to work with onchain yield options and automated compounding workflows.

Whether you scalp intra-day moves, run longer-horizon momentum, or simply want a clean portfolio view, Axiom streamlines your DeFi stack with a unified interface and institutional-grade security.

How Axiom Works

Three simple steps to start trading onchain with confidence.

Create or Connect a Wallet

Use Axiom’s non-custodial wallet or connect your existing wallet to retain complete control of your keys and funds.

Fund & Discover Opportunities

Deposit assets, follow smart wallets, and surface trending markets through social & onchain signals.

Trade, Earn & Automate

Execute perps, manage risk, harvest yield, and set alerts/automations—all in one place.

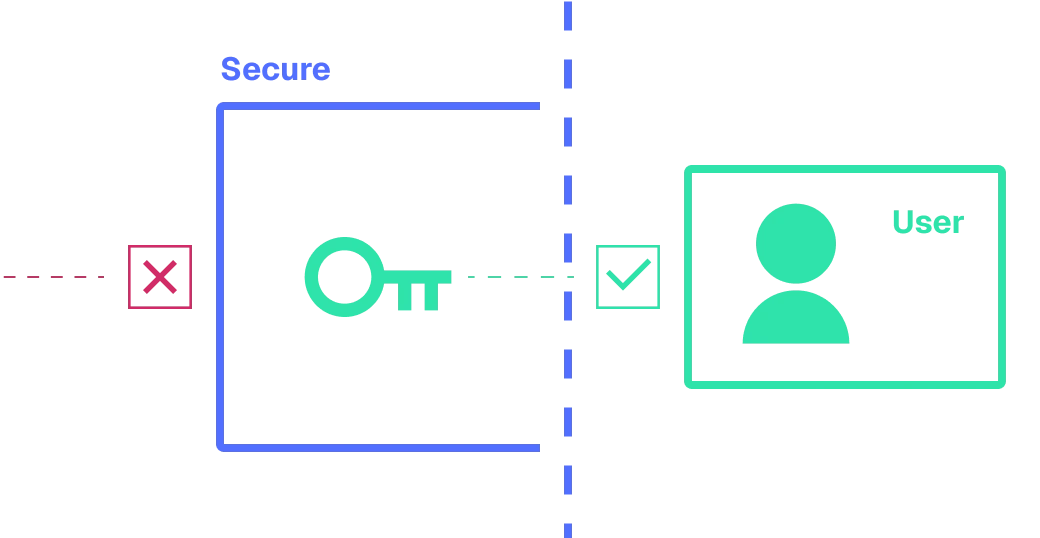

Axiom integrates leading DeFi protocols and analytics so you can analyze markets, place trades, and track P&L with minimal friction. With a non-custodial architecture and air-gapped key management, you maintain sovereignty over funds while accessing an advanced trading experience.

Integrations & Security

Seamless protocol access with robust, non-custodial protection.

Seamless Integrations

Axiom consolidates your onchain activity—market data, execution, portfolio, and alerts—so you don’t need multiple tabs or complex setups. Get a unified view of DeFi without compromising control.

Non-Custodial by Design

Keys are secured by modern, air-gapped infrastructure. Your assets are always in your control and transactions are verifiable onchain. Reduce counterparty risk without sacrificing performance.

Migration Tools & Pro Trading Suite

Bring your strategy with you. Move faster with purpose-built utilities for switching venues, reacting to flow, and executing with precision.

Migration Tools

Mirror positions and balances with guided flows. Map assets one-to-one, preview slippage and funding, and shift exposure with minimal downtime.

Buy on Migration

Automatically open replacement longs as you exit legacy venues. Set size, max price impact, and time-in-force to control costs during the move.

Sell on Migration

Close or reduce positions while simultaneously establishing hedges. Keep portfolio delta stable as liquidity shifts.

Spot Buys

Stack inventory on supported DEXs with one-tap size presets, alerts for fills, and optional DCA schedules.

Quick Sell

Exit to stables or rotate risk in seconds. Configure slippage tolerances, route preferences, and receive execution receipts onchain.

Twitter Monitor

Follow curated lists and project accounts. Trigger alerts on keyword spikes, verified mentions, and sudden engagement bursts that may precede moves.

Wallet Tracking

Shadow high-signal addresses, observe P&L and open interest footprints, and copy or fade with guardrails like max slip and per-trade caps.

Limit Orders

Place maker-first orders with advanced conditions: OCO, trail, reduce-only, and post-only. Manage ladders directly from the chart.

…and so much more

From funding/APR dashboards to strategy automations, webhooks, and portfolio exports—Axiom keeps shipping power features to streamline your edge.

Axiom’s Pro Trading Suite is engineered for serious traders who demand institutional-grade functionality in a decentralized context. Every component—from migration flows to signal ingestion—gives you precise control over execution, liquidity access, and information flow. By offering granular tools such as one-click risk rotation, wallet mirroring, and configurable limit ladders, Axiom transforms fragmented workflows into a unified experience.

Beyond the tools, the suite integrates analytics that track funding rates, perp open interest, volatility, and liquidity fragmentation across venues. Run comparative simulations, visualize order book depth, and export detailed P&L—either as CSV or via APIs. These capabilities empower both discretionary and systematic approaches to maximize edge while maintaining discipline.

Automation sits at the core: define triggers for profit-taking, rebalancing, or liquidation defense. The rules engine supports conditional logic, time-based schedules, and webhooks. Rotate profits into yield pools after a successful perp trade, or auto-hedge when wallet exposure drifts beyond thresholds—all verifiable onchain.

Embedded education—contextual tips, dynamic FAQs, and guided walkthroughs—keeps the learning curve smooth. Paired with active community channels on Twitter and Discord, you gain tactical insights without leaving your terminal.

Case study: a delta-neutral desk migrates exposure between venues in minutes. As migration executes, hedges establish in parallel, collateral rebalances automatically, and Twitter Monitor flags project-specific catalysts. The result: faster response time, lower risk, and cleaner bookkeeping.

Roadmap highlights include ML-driven signal detection, collaborative trading rooms, and cross-chain liquidity bridges. The mission is simple: help you move capital and conviction at the speed of crypto—without sacrificing transparency or control.

No custodial lock-in • Onchain execution • Configurable guardrails

Get Paid to Trade

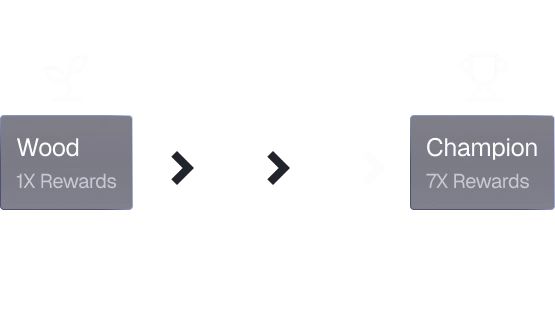

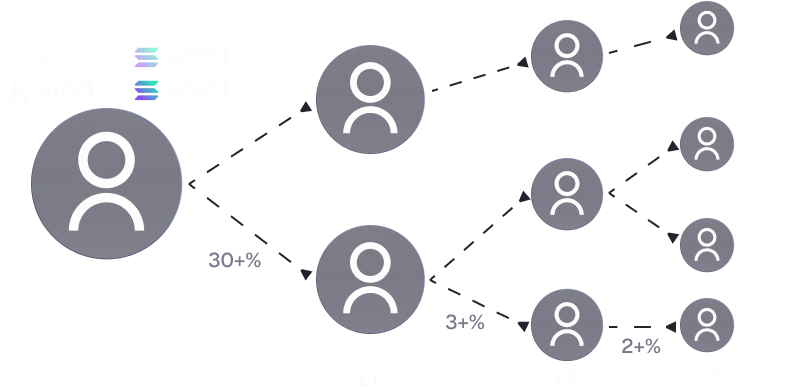

Earn SOL, climb ranks, and unlock higher reward multipliers through referrals and activity.

Progress Through Ranks

Active traders earn more. Increase reward rates as you move up the leaderboard.

Juicy Referrals

Invite friends and earn points plus a share of fees in SOL when they trade.

Affiliate link: conversions may be tracked for rewards.

Frequently Asked Questions

Quick answers about security, fees, supported markets, and getting started.